To examine the effects of COVID-19 on small-scale manufacturing firms, we have conducted a survey of 627 randomly chosen small-scale manufacturing firms in different parts of Ethiopia. The large majority of firms remain open. However, over 95% of firms have seen a decline in sales, by 55% on average, in September 2020 compared with the same period last year and layoffs have already occurred. Loss of customers due to mobility restrictions is reported as the biggest business challenge during the pandemic. Firms indicate that business loans are the most appropriate policy response to mitigate the negative impact of the pandemic on their business.

COVID-19 reached Ethiopia in mid-March 2020. As of 1 November 2020, near to 100,000 cases had been reported with 1,600 deaths. Fear of dealing with a new virus in the context of ill-equipped health systems and a vulnerable economy energized the country’s leadership to the early imposition of stringent measures including borderland control measures, travel bans, social distancing measures, and lockdowns. However, these health measures put pressure on small-scale manufacturing firms – defined as those that employ less than ten workers and use power-driven machinery – making them uniquely positioned to be the hardest hit. At the same time, small-scale establishments play a key role in job creation employing more than two million workers. In particular, they are a vital source of employment and livelihood for low-skilled women and low-income households.

Thus, to examine these effects of COVID-19, we have conducted a survey of 627 randomly chosen small-scale manufacturing firms from a recent database of the Central Statistics Authority of Ethiopia (CSA). The survey was conducted over the phone in early October 2020. Most respondents were firm owners or firm managers. In our sample, the average number of workers employed in the firms is five while the median employee count is four. Approximately 36% of small-scale firms have at least one female owner. Average annual sales in 2019 were 386,467 Birr (approximately $10,000).

The survey findings reveal that the large majority of businesses, close to 95%, remain open. Fewer than 1.0% of the businesses in our sample are temporarily closed because of government mandate and roughly 1.4% of businesses are closed due to challenges related to the COVID-19 outbreak. 1.7% of businesses are either temporarily or permanently closed due to factors unrelated to the COVID-19 outbreak. Only 1.1% of the firms are permanently closed due to challenges related to the COVID-19 outbreak.

Of the 627 surveyed establishments, over 95% of firms have seen a drop in sales with an average decline of 55% in September 2020 compared with the same period last year. 87% of firms expected their sales to decrease for the next 30 days compared to their sales in the same period last year.

Many workers in small-scale firms have lost their jobs and income as a result of the COVID-19 pandemic. Since the pandemic, 17.3% and 17.2% of workers experienced temporary and permanent layoff respectively, while 18.3% of workers faced a reduction in earnings. The layoffs, temporary and permanent, are a little lower for firms with more than five employees. For firms that employ more than five workers, 12.2% and 10.0% of workers experienced temporary and permanent layoff respectively, while 15.9% of workers faced a reduction in earnings.

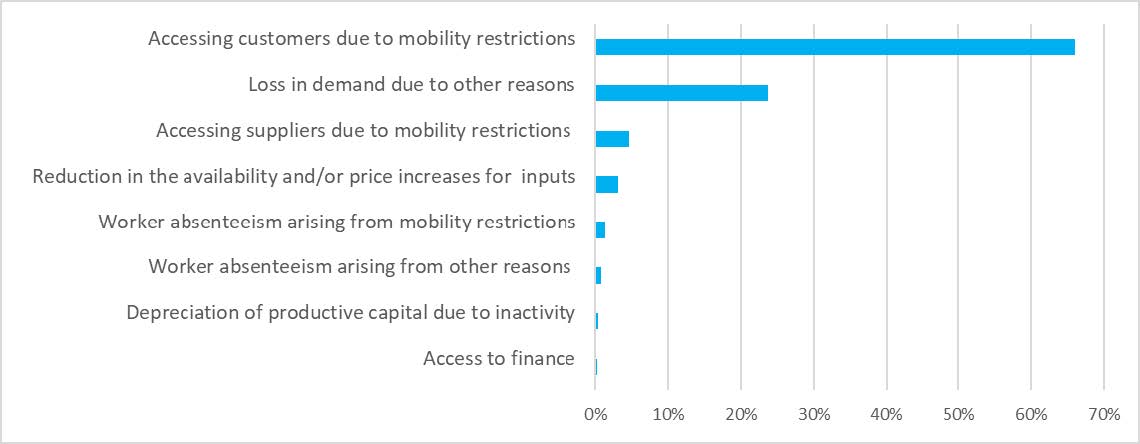

Figure 1 shows the challenges small-scale manufacturing firms face due to the COVID-19 outbreak and its related restrictions. Two thirds of firms reported that accessing customers due to mobility restrictions imposed by the government is the main challenge they faced in their business operations. Similarly, close to a quarter of firms reported that the loss in demand due to other reasons unrelated to government mobility restriction as the second major challenge for their business operation. It means that almost 90% of the firms identified lack of demand as a main challenge for their business operations, either due to government restrictions or other reasons. The third most common main challenge, reported by 4.6% of establishments, was accessing suppliers due to mobility restrictions imposed by the government.

Figure 1: Main challenges firms faced due to COVID-19 and its restrictions

Note: This figure plots the proportion of firms that selected each response to the question “In the last 30 days, has your business been facing any of the following challenges due to the coronavirus/COVID-19 outbreak and related restrictions?”

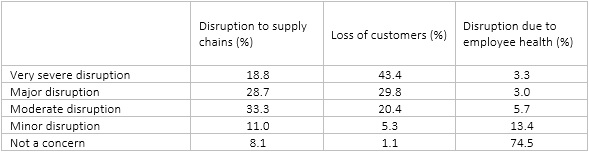

We also asked firms to rate the difficulties resulting from supply chain disruptions, demand shocks, and employee health disruptions due to challenges of COVID-19. Consistent with previous results, Table 1 shows that lack of demand is considered a very severe or major disruption by 43% and 30% of firms respectively. In sum, over 93% of firms cited a loss of customers as a result of COVID-19 as a significant disruption to their business activity. Disruption to supply chains is also cited as a serious problem while disruption due to employee health is less of a concern for firms.

Table 1: COVID-19 and production disruption

Note: This table shows the proportion of firms that selected each response to the question “How would you rate the difficulties (disruptions) resulting from the following challenges due to COVID-19?”

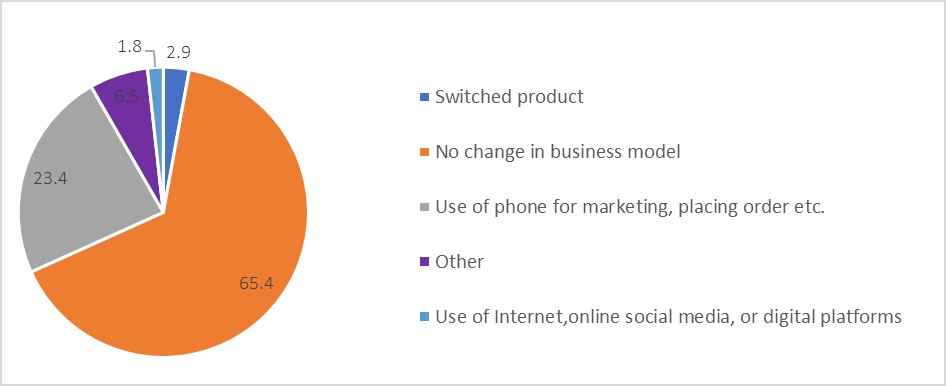

Regarding the coping strategies with the loss of customers, we asked whether small-scale firms adjusted their business model to avoid being in physical proximity with customers. Figure 2 shows that close to two thirds of firms reported no change in their business models. However, 23% of small-scale businesses reported changing their business model by using phones for placing orders, marketing and other activities. Only a small proportion of firms (2.9%) switched the products they sold.

Figure 2: Has your firm adjusted its business model

Note: This figure plots the proportion of firms that selected each response to the question “Has your business adjusted its business model to reduce being directly in physical proximity with customers?”

One of the reasons why small-scale firms are uniquely positioned to be affected by COVID-19 is related to their financial vulnerability to shocks. To reveal firms’ financial fragility before the pandemic, we asked two questions. The first question asked was “Did this establishment have a line of credit or a loan from a financial institution at the beginning of the fiscal year in 2019?” We find that an overwhelming 83% of firms did not have a line of credit from a financial institution before the pandemic in 2019. The second question asked was “Does this establishment have a credit facility now?” 91% of firms reported that they do not currently have a credit facility, indicating the unique vulnerability of small-scale firms to the COVID-19 crisis.

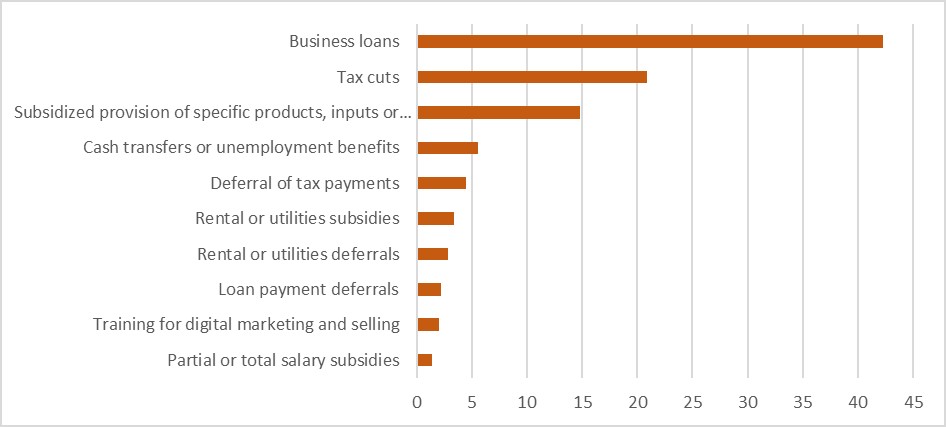

The survey also asked what policies are most needed to support businesses over the COVID-19 crisis. Figure 3 shows that 42% of firms believe that business loans are the most appropriate policy response followed by tax cuts (21%). 15% of firms consider a subsidy to be the best policy response while only 6% of businesses see cash transfers or unemployment benefits as the most appropriate.

Figure 3: What would be the most needed policy to support your business over the COVID-19 crisis?

Note: This figure plots the proportion of firms that selected each response to the question “What would be the most needed policy to support your business over the COVID-19 crisis?”

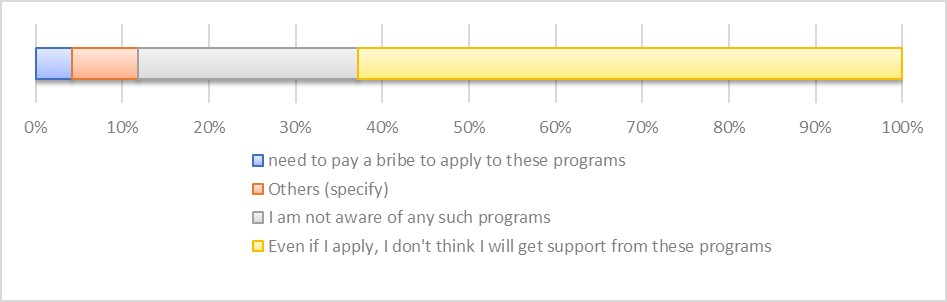

We asked firms whether they have applied for or are currently receiving any government programs to support their business. 29% of firms have either applied for business loans or are currently receiving business loan support and 5% responded that they are benefitting from tax cuts. 51% of firms have not applied for any program to support their business. As Figure 4 shows, of these firms that have not applied for any government programs, about 60% do not believe they will get any support even if they apply. 25% of these firms are not aware of any government support programs.

Figure 4: Why have you not applied to any government programs?

Note: This figure plots the proportion of firms that selected each response to the question “Why have you not applied to any government programs?”

Overall, our results underscore the negative effect of COVID-19 on small-scale manufacturing firms in Ethiopia. Though most firms remain open, over 95% of them have seen a drop in revenue, by 55% on average, in September 2020 compared with the same period last year. Firms have also reported laying off workers and among the channels through which COVID-19 affects firms’ business operations, loss in demand is found to be the most important challenge. Close to 90% of the firms identified lack of demand as the main problem for their business operations, largely because of difficulty accessing customers due to government-mandated mobility restrictions. Firms report that the provision of business loans would be the most effective policy for the government to undertake to mitigate the negative effects of the pandemic.

This note is based on research conducted as a part of PEDL project ERG 7872.