We conducted three rounds of phone surveys with wholesale and retail traders in Lagos, Nigeria, to understand how their businesses were impacted by the COVID-19 pandemic and associated policy responses. We find high short-run compliance with public health measures, even though traders had virtually zero revenue during a month-long lockdown. After reopening, sales rebounded more than employment although neither returned to pre-pandemic levels. Traders reported low sales, lack of cash on hand, and challenges with sourcing as significant problems facing their business. Although most traders raised their prices to cope with the impacts, very few took out loans. Traders are interested in new strategies to cope with low demand and supply challenges. Policies to facilitate traders’ access to e-commerce and remote sales, as well as strategies to improve supply chain failures could help address these issues.

Micro, small, and medium enterprises (MSME) engaged in wholesale and retail trade represent both a major segment of the economy and source of employment in developing countries. They also constitute a key link in the supply chains that carry goods to consumers. Understanding the impact of the COVID-19 pandemic on MSMEs in the trading sector, and the ways they adapt to it, is therefore crucial for developing policy responses that will influence livelihoods as well as the price and availability of consumer goods.

In Lagos, Nigeria, wholesale and retail businesses were impacted by a lockdown that lasted from 26 March to 4 May 2020, as well as a range of continuing restrictions on market activity and travel after the lockdown was lifted. We conducted three rounds of phone surveys with 765 traders in Lagos between 18 April and 20 July 2020 to understand how their businesses were impacted by policy restrictions and the pandemic more broadly. These traders were drawn from the sample for the Lagos Trader Survey (LTS), a panel survey of 1,179 wholesale and retail traders in Lagos, Nigeria, who buy and sell consumer goods such as clothing, electronics, toiletries, and homewares. Traders were randomly sampled from a census of 53,000 shops in commercial areas of Lagos State, and have been followed since 2015.

All traders in the sample operate from permanent physical premises. The typical trader is male (73%), 42 years old, and has been in business for 14 years. As of 2017, traders had 1.3 shops and 1.2 paid and unpaid workers on average. In February 2020, before the pandemic hit Nigeria, their average weekly revenue was just under NGN 400,000 (approximately USD 1,030). Two thirds of them imported goods from outside Nigeria in 2019.

Traders’ businesses were heavily impacted by the Lagos State lockdown. Almost all operated in markets that closed during the lockdown. Only 15% of traders considered their businesses to be in operation, and 91% reported zero revenue in the week prior to the survey. However, traders’ businesses appeared to survive the lockdown. From 4 May, markets were permitted to open three days per week, from 9 am to 3 pm. From that point forward, 85% of traders considered their businesses to be currently in operation, and almost all of the remainder expected to reopen in the future. A minority (21%) reported zero profits in at least one week in May or June, either because they had personally chosen not to return to their shops yet, or because business was very slow.

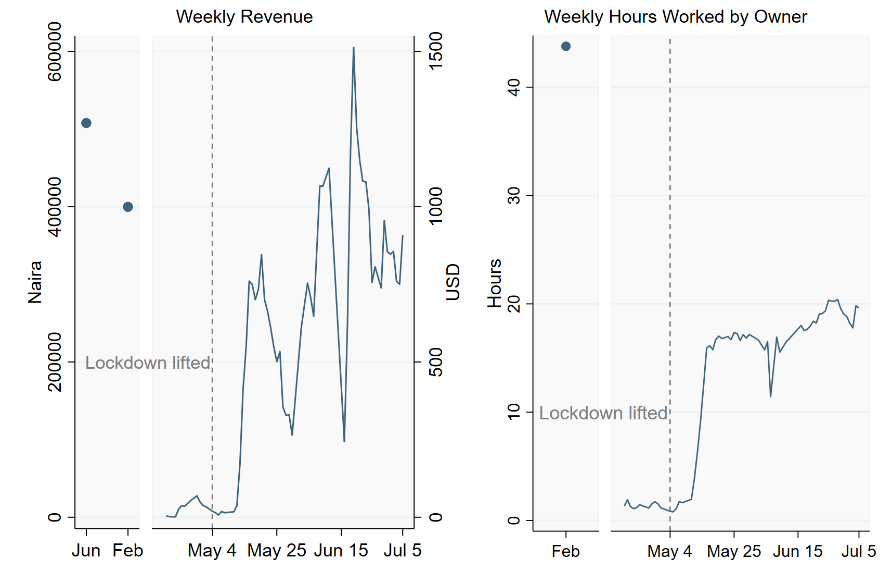

Figure 1: Weekly revenue and weekly hours worked by owner

Note: Average value for a week in June 2019 and February 2020 reported as a single point. Values smoothed using a seven-day simple moving average.

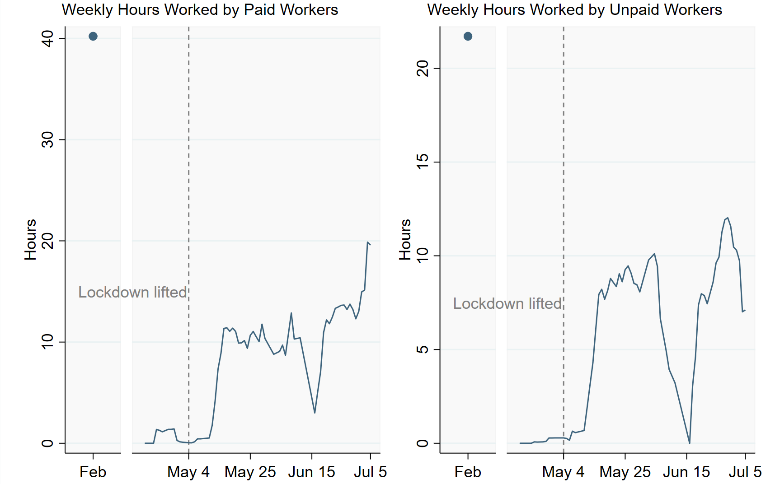

Figure 2: Weekly hours worked by paid and unpaid workers

Note: Average value for a week in February 2020 reported as a single point. Values smooth using a seven-day simple moving average.

Sales rose substantially after the re-opening and recovered more than work hours (see Figure 1). Average weekly revenue rose to NGN 359,000 (USD 935) in June, which was approximately two thirds of the average revenue in June of the previous year. Hours spent working in the business by traders themselves was still less than half of their pre-pandemic levels. Employment was also still much lower than the pre-lockdown average (see Figure 2). Average hours worked by all paid workers in June were still down by two thirds compared to February, from 40 hours per week total across all paid workers in the business to 13. Total hours by unpaid workers fell from an average of 22 hours in February, to only nine hours even after the lockdown was lifted.

Support for the lockdown was high (78% approving) in spite of the fact that traders reported their household incomes had fallen by 94%, and a majority were “very worried” about accessing necessities for their families. Almost all reported that their markets were closed, and very few visited their shops. Most traders reopened their businesses after the lockdown was relaxed. However, shops were on average open only three days per week, consistent with the terms of the remaining lockdown restrictions. In May, 96% of traders reported their market opening at 9 am or later and closing at 3 pm or earlier as required.

As of May, mask use was high in markets among both business owners and customers – traders on average estimated that 93% of people at markets were wearing masks. Hand hygiene options were also good, with over 94% of traders reporting that hand sanitizer and handwashing stations were available at the market. However, the majority of traders reported that there was no temperature control at market entrances.

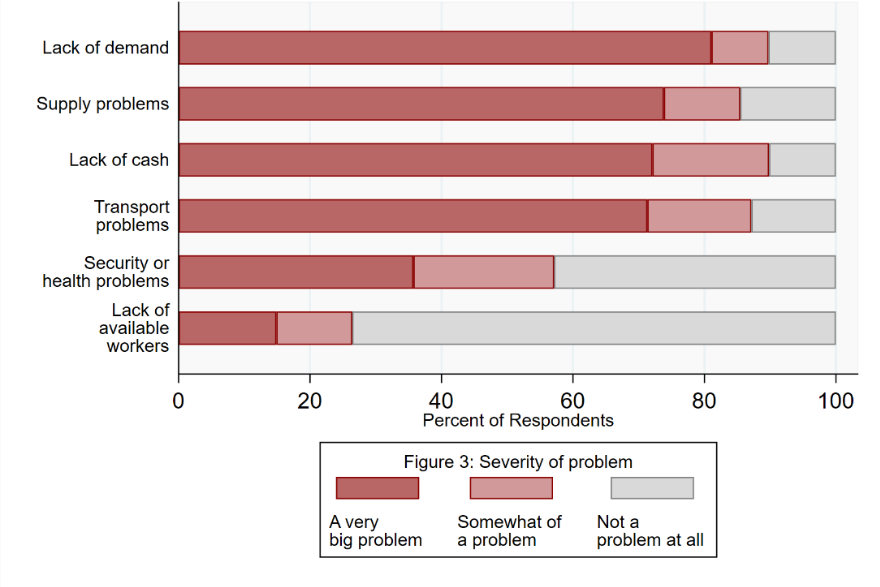

Traders were concerned about approaching business costs (including costs that were due in arrears from the lockdown period) but most expected to be able to pay these costs as of June, and intended to use cash on hand rather than taking out loans or selling assets. Traders also said they were affected by low demand and transportation problems (see Figure 3), both within Lagos to reach their shops and in receiving goods purchased from their suppliers.

Figure 3: Problems affecting business by severity

The majority of traders had already increased or planned to increase their prices. Few intended to change their line of business at the time. There was widespread interest in e-commerce and new remote approaches to business. Most were interested in increasing their use of electronic payment methods relative to cash and a quarter were interested in sourcing goods online. 42% were finding new ways to deliver their goods to consumers. Over 80% said they planned to sell through social media in the next six months, and 48% planned to sell online in the next six months, compared to only 62% and 11%, respectively, who had done so in the past.

In May, traders reported that the majority of their sales were done remotely. That number fell in June and July (see Figure 4), suggesting that traders were returning to their normal business patterns as customer mobility increased, rather than pursuing new remote sales and delivery strategies on a large scale.

This may have been in part due to traders’ general optimism about the speed with which they would be able to return to their usual ways of doing business. When interviewed in June, the large majority of traders said they expected business to return to normal within a month, including the lifting of restrictions on domestic and international travel.

Figure 4: Fraction of sales remote

Note: Average value for a week in February 2020 reported as a single point. Values smooth using a seven-day simple moving average.

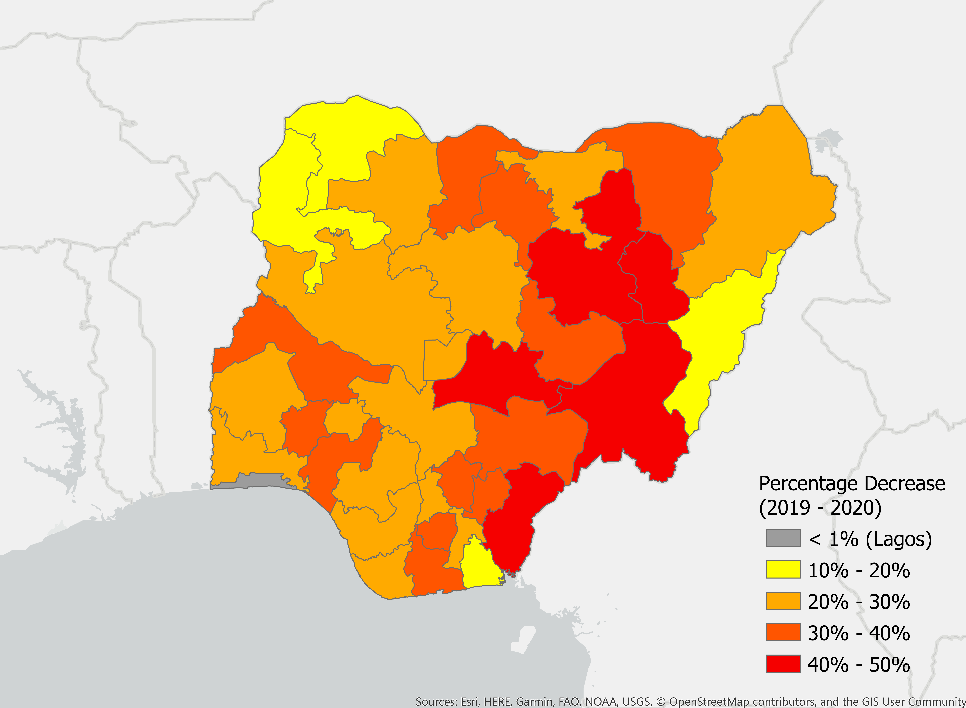

Lagos traders serve demand from throughout Nigeria, and so were heavily impacted by the ban on interstate travel that was in place until July. Traders were less likely to report having customers from outside Lagos in 2020 compared to 2019 (see Figure 5). In 2019, 44% of traders’ sales were from outside Lagos. In 2020 only 26% of their (reduced) sales came from outside Lagos. Customers from out of state were substantially less likely to travel to Lagos to buy in-person. These numbers likely shifted after the ban on interstate travel was lifted.

Challenges with restocking was an ongoing issue, before, during, and after the Lagos lockdown. Most traders reported that restocking became a problem well before the lockdown, in January or February 2020. Three quarters said that supply challenges were a major problem (see Figure 3). As of May, traders on average had one-month’s worth of goods in stock. Only 64% had successfully purchased any goods for their business so far in 2020, while all had done so in 2019. Most had at least attempted to source in 2020, with common problems cited including transportation difficulties and suppliers being out of stock. Traders were facing these challenges when attempting to source domestically, as well as internationally.

Traders reported a bigger drop in importing than in purchasing overall, but domestic sourcing does not appear to have been a good substitute for international sourcing. Only a few traders who did not buy domestically in 2019 started doing so in 2020.

Figure 5: Percentage decrease in traders with customers in each state (2019-2020)

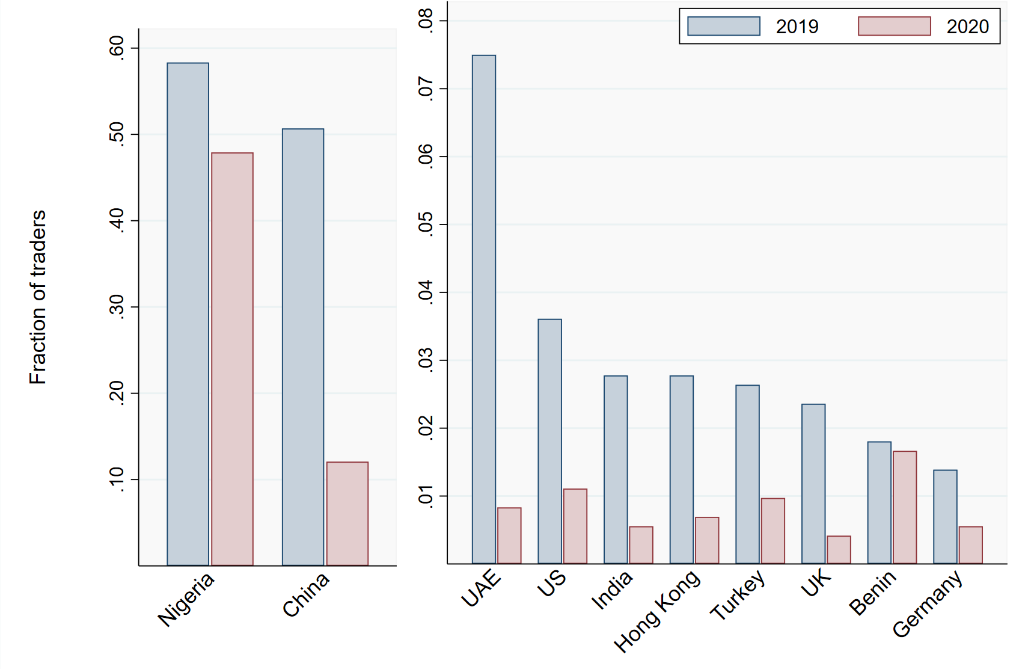

Figure 6: Fraction of traders sourcing from country by year

Even for domestic sourcing, the number and total value of purchases fell by well over half compared to a comparable period in 2020. Importing took a very large hit. For instance, over half of interviewed traders sourced from China in 2019, while only about 12% did so in 2020 (see Figure 6). This was likely due to a combination of factors including supply problems in China, transportation challenges, travel bans, and low demand. About a quarter of traders who sourced from China in 2019 travelled there in person to buy, while only 5% of those who bought in 2020 did so.

To address these difficulties, traders planned to find new suppliers (29%) and add new products (43%), but fewer expected to change the countries they source from (8%), stop selling any current products (7%) or to fully change their line of business (12%).

Small businesses in Nigeria have had little government support in coping with the economic challenges of the pandemic, either in terms of palliatives to address income loss or access to loans to sustain their business operations. The results of our surveys suggest that wholesale and retail traders have been dealing with particular challenges related to being cut off from their supply chains. They have also been interested in new business strategies that would facilitate remote operations, such as buying and selling online, using electronic payments, and improved delivery logistics, but their use of such strategies has been limited thus far, suggesting that they have faced barriers to take-up. More work is needed to understand how policy approaches could improve access to and take-up of these technologies.

Editor's Note: This project was also funded by IGC. A policy brief based on the first two survey rounds was published by IGC in July 2020.

This note is based on research conducted as a part of PEDL MRG 6821.